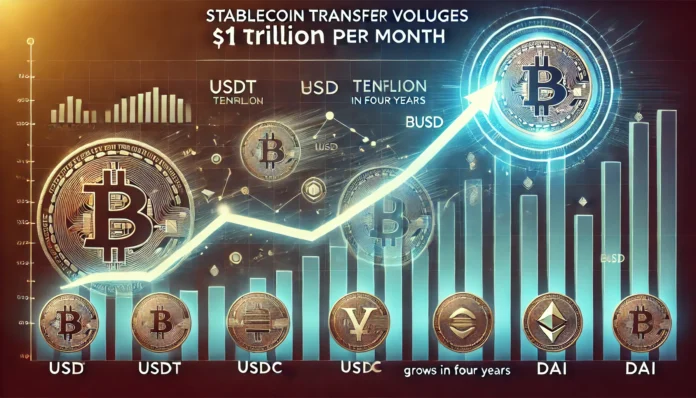

Stablecoin transfer volumes have surged tenfold over the past four years, reaching $1 trillion per month. This growth highlights the increasing adoption and use of stablecoins in the cryptocurrency market.

Stablecoin Transfer Volumes Increase Tenfold in 4 Years, Reaching $1 Trillion Monthly

Stablecoin Usage Surges Over Four Years

Stablecoin transfer volumes have seen a dramatic increase over the past four years, now reaching $1 trillion per month. This tenfold growth underscores the rising adoption of stablecoins, which are digital assets pegged to traditional currencies like the US dollar, offering stability and utility in volatile markets.

Key Drivers of Growth

Several factors contribute to this surge. The increased use of stablecoins in decentralized finance (DeFi) platforms, cross-border transactions, and as a trading pair on exchanges have all played significant roles. Additionally, their ability to provide a hedge against volatility in the cryptocurrency market has made them a popular choice among users and institutions alike.

Why This Is Important

The massive growth in stablecoin transfer volumes indicates a shift towards more stable and reliable digital assets in the crypto space. This trend highlights the evolving nature of the market, with stablecoins becoming integral to various financial activities and services.

Possible Implications

Market Stability: The widespread adoption of stablecoins can contribute to greater market stability, providing a reliable medium of exchange and store of value.

Regulatory Attention: The increasing use of stablecoins may attract more regulatory scrutiny, as authorities look to ensure that these digital assets are used safely and transparently.

Financial Inclusion: Stablecoins offer opportunities for greater financial inclusion, especially in regions with unstable local currencies or limited access to traditional banking services.

Coins to Follow

Tether (USDT): The most widely used stablecoin, Tether’s market movements are crucial to understanding the overall stablecoin landscape.

USD Coin (USDC): A rapidly growing stablecoin, USDC’s adoption and regulatory compliance are significant indicators of market trends.

Binance USD (BUSD): Binance’s stablecoin, BUSD, plays a critical role in the exchange’s ecosystem and its integration with various DeFi projects.

Dai (DAI): A decentralized stablecoin, Dai’s performance and usage in DeFi platforms offer insights into the broader decentralized finance market.

What to Follow

Regulatory Updates: Stay informed about new regulations and guidelines affecting stablecoins, particularly in major markets like the US and the EU.

Market Trends: Monitor trends in stablecoin adoption, trading volumes, and their integration into new financial products and services.

Technological Developments: Keep an eye on advancements in blockchain technology that could impact stablecoin efficiency, security, and usability.

Conclusion

The tenfold increase in stablecoin transfer volumes over the past four years highlights the growing importance of these digital assets in the cryptocurrency market. As stablecoins continue to play a crucial role in financial transactions, their impact on market stability, regulation, and financial inclusion will be closely watched.

Source: Bitcoin News